Valuation Services

sbLiftOff speaks GovCon

sbLiftOff offers a valuation package to provide informed decision-making support with a deep understanding of the GovCon, Software, and SaaS markets.

Business Valuation Services From sbLiftOff

Are you looking to sell all/part of your company? Maybe you’re looking to restructure or bring on a partner? An sbLiftOff valuation provides you with the support to make informed decisions with actionable insights. Our transaction and consulting experience enables us to analyze, model, and value companies. However, valuations can be just as much art as they are science. The ‘art’ of the valuation comes with experience and expertise – sbLiftOff goes beyond the numbers and spreadsheets to understand your unique narrative. We will provide thoughtful valuation guidance to help you navigate today’s market.

Download a copy of our Valuation Overview.

sbLiftOff Speaks GovCon, Software, and SaaS

With a deep expertise and understanding of the GovCon, Software, and SaaS markets, sbLiftOff provides specifically tailored insights to help you get the most value out of your business. GovCon companies have different business fundamentals and buyer universes compared to commercial companies, from pipeline to backlog, set-asides to sizing out, past performance to recompetes, and affiliation to novation.

Similarly, software and software-as-a-service (SaaS) companies require specialized knowledge of recurring revenue models, customer acquisition costs, churn rates, and technology stack valuations that other advisors often overlook. sbLiftOff lives and breathes both sectors.

When Does Your Business Need Merger and Acquisition Valuation Services?

Business owners need to know their company’s fair market value for various reasons. A professional valuation contributes to sound decisions and helps to avoid costly missteps. If you are planning a growth strategy or are in the midst of a sale, merger, or acquisition, knowledge of the market is essential.

Examples of when these services are beneficial include:

- Mergers and acquisitions (M&A): Valuation insights reveal what price range you can expect in today’s market while you prepare to sell and before you start talking to buyers. It also shows you everything buyers will focus on when evaluating your business — both positive and negative — so you can prepare your responses beforehand.

- Management buyout: If credible buyers exist inside the company prior to a transaction, it will be essential to know the business’s fair market value and test whether a management buyout is feasible.

- Proactive succession planning: Establishing next-generation management is best practice and requires knowledge of the company’s position in the market today and in the future.

- Creating a growth strategy: If you’re deciding whether to expand or buy another company, you need to know what your business is worth. Valuation helps you determine whether spending money on growth makes sense or if you should focus on other priorities.

- Considering an acquisition or tuck-in: You need to know the fair market value of the target business before you decide to purchase it. A valuation prevents you from overpaying and helps you identify opportunities where a merger would be worth more than managing each one separately.

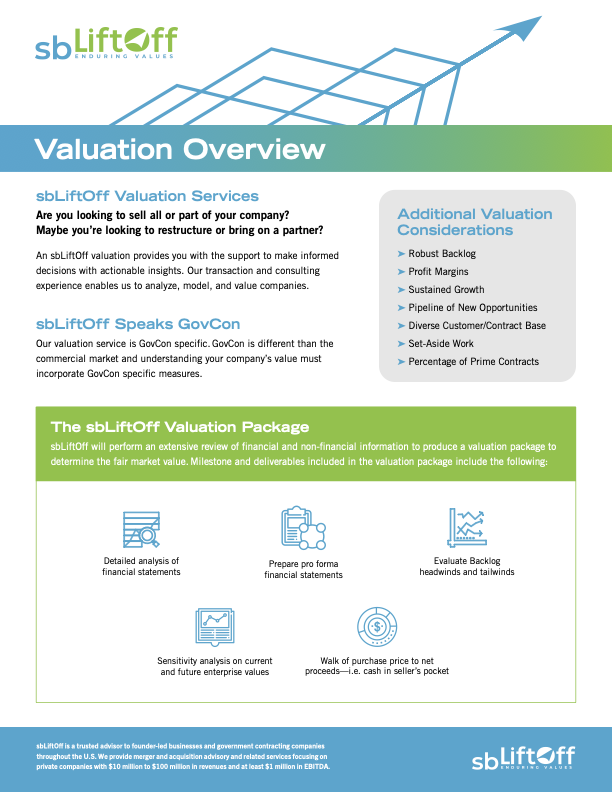

The sbLiftOff Valuation Package

sbLiftOff will perform an extensive review of financial and non-financial information to produce a valuation package to serve as an expert opinion in determining the fair market value (i.e. business appraisal). The valuation package will be prepared for internal planning, restructuring, and buy-sell purposes.

Milestones and deliverables included in the valuation package include the following:

1. Detailed analysis of financial statements

2. Prepare pro forma financial statements

3. Evaluate Backlog headwinds

and tailwinds

4. Sensitivity analysis on current &

future enterprise values

5. Walk of purchase price to net

proceeds – i.e. cash in seller’s pocket

Benefits of Choosing sbLiftOff for M&A Valuation Services

Evaluating a business requires significantly more than running numbers through basic accounting formulas. You need to understand your industry’s key performance indicators (KPIs) and what potential buyers value the most. While some firms assess businesses with one-size-fits-all strategies, the sbLiftOff team understands the GovCon, Software, and SaaS markets, integrating the factors that drive value for buyers.

Benefits you’ll enjoy when partnering with us include:

- Experience: Our valuation team has helped complete transitions by providing practical knowledge of what drives each market, from information technology and cybersecurity to data analytics and facilities maintenance. We understand the GovCon, Software, and SaaS metrics that potential buyers value most.

- Market-based valuations: We apply market-based, income-based, and asset-based valuation methodologies using current transaction data and industry benchmarks. Our pro forma adjustments normalize for one-time events, owner compensation, and nonoperational expenses to present the true earning potential that buyers must prioritize.

- Customized solutions: Our team looks at your company’s specific situation, whether for transition preparation, strategic planning, or litigation support. We analyze your contract backlog for recompete risks, evaluate competitive positioning within your market, and model scenarios that apply to your specific business objectives.

- Timely and efficient service: sbLiftOff provides some of the industry’s fastest turnaround times for valuation services. Our streamlined data collection process minimizes time requirements while providing an extensive analysis of financial performance, operational metrics, and market positioning.

Discover More About Merger and Acquisition Valuation With sbLiftOff

Whether you’re preparing for a transition, evaluating growth opportunities, or need expert valuation for strategic planning, sbLiftOff delivers the technical expertise and market knowledge required for confident decision-making. Our team is excited to learn about your business and recommend a strategy suited to your personal goals. Get in touch with us today to schedule a consultation.