Services

A trusted advisor to founder-led businesses and GovCon companies throughout the U.S, we provide M&A advisory focusing on private companies with $10 million to $100 million in revenues

Mergers & acquisitions advisory services

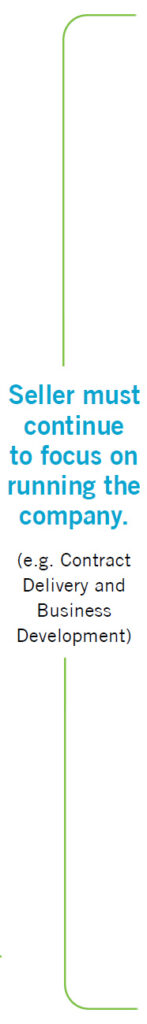

Preparation

- Compilation/Analysis of Financials and Client Concentration

- Assess Market Position; Review Strengths and Challenges

- Data Room Established

- CIM/Teaser Completed

- Legal Review of NDA

- Prepare List of Potential Buyers

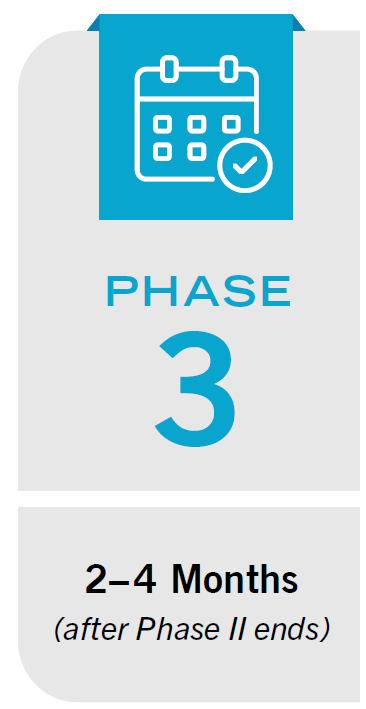

Buyer Identification

- Market Outreach Begins

- NDAs Signed and Catalogued

- Respond to Inquiries from Potential Buyers

- Buyer Qualification

- Extensive Due Diligence

- Management Meetings

- Letter of Intent (LOI) Negotiations

- Ends when LOI is Signed

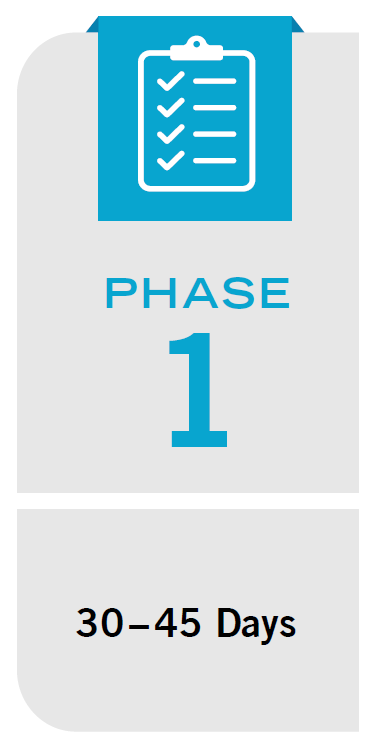

LOI to Close

- Extensive Confirmatory Due Diligence

- Financing Obtained

- Negotiation of Legal Documents (Legal and

Commercial Terms) - Ends when Closing Occurs

Why sbLiftOff

Deep expertise in Government Contracting

Extensive GovCon network of buyers, sellers, accountants, lawyers, commercial bankers, and others

Sophisticated process to identify, qualify/screen, and engage potential target companies

Hands on collaborative transaction team from preparation to close

Compensation largely contingent on successful transaction close

Preparation

Acquisition Focus

- Define Industry Focus

- Develop Company Criteria

Target Outreach & Engagement

Account Based Marketing

- Track Target Accounts

- Screen & Qualify Leads

- Engage Target Accounts

- Facilitate Management Meetings

LOI to Close

Confirmatory Due Diligence

- Financial

- Legal

- Regulatory

- Tax

Negotiate Deal Terms

- Structuring

- Escrow

- Net Working Capital Target

- Tax Treatment

- Research Total Addressable Market Financing

- Debt – Equity Strategy Development

Preliminary Due Diligence

- Financial Analysis

- Determine Purchase Price

- Contract & Client Concentration

- Determine Deal Structure

- Backlog & Pipeline

- Negotiate LOI

- Size-out Considerations

Prepare and Finalize Legal Docs

- Purchase Agreement

- Operating Agreement

- Disclosure Schedules

- Closing Checklist

Why sbLiftOff

Deep expertise in Government Contracting

Exhaustive research to develop your Total Addressable Market

Sophisticated process to identify, qualify/screen, and engage potential target companies

Hands on collaborative transactions team to bring deals to close

Fee largely contingent on success of a transaction