When selling your company, an M&A advisor can help you determine what your company is worth.

One of the key aspects when selling a company is determining its value. Too high of a valuation may turn off potential buyers, while a valuation that is too low could leave a sizeable amount of money on the table.

A valuation represents your company’s total worth. This is a calculation that takes into account a company’s assets, earnings, expenses, and debt, as well as market and industry trends. Assets are comprised of both tangible and intangible assets. Tangible assets include equipment, inventory, and real estate. For service-oriented businesses, a sizeable component of value lies in intangibles such as brand name, management, talent, intellectual property, and customer databases.

While there are several methods of company valuation, the most commonly used for M&A deals are discounted cash flow and comparable company analyses. Unlike valuation based on discounted cash flow analysis, the comparable approach does not require detailed multiple-year cash flow projections.

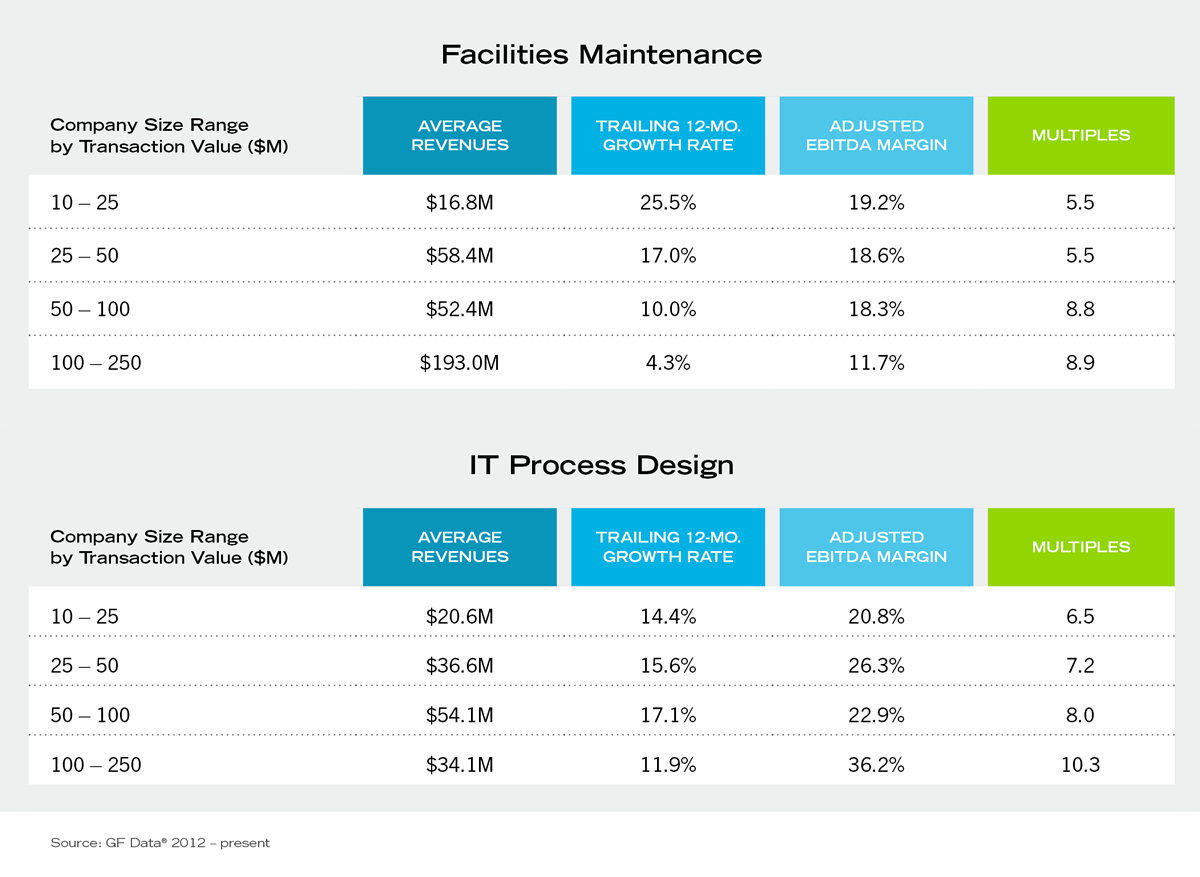

The market will assign a multiple for your company based on how similar companies have sold and current market conditions. Currently, the market is trading at near record highs; according to private M&A data provider GF Data, the average valuation of private M&A transactions for companies with a total enterprise value of $10 million to $25 million through the third quarter of 2021 was 6.0x EBITDA.

This trend is expected to continue for several years, bolstered by the low interest rate environment and record amounts of private equity and corporate cash available for acquisitions. However, only the strongest and best companies are getting high valuations. Weaker companies are either trading at lower valuations, or not selling at all.

5 key steps to valuing your company:

1

Determine your EBITDA

Take net income for the last 12 months or fiscal year, and add interest paid, income taxes paid, depreciation and amortization. EBITDA is a very concrete indication of a company’s earnings power.

2

Adjust your EBITDA

This step makes reasonable adjustments to the EBITDA to make the company’s cash flow as representative as possible to what the buyer will experience over the long run.

- Increase EBITDA by expenses incurred in the last 12 months that the new owner would not incur, such as personal expenses, additional people on payroll, non-business travel, cars, or other professional fees outside the ordinary course of business.

- Decrease EBITDA by non-recurring income such as favorable legal judgment or sale of assets outside the ordinary course of business.

- Decrease EBITDA by expenses that the buyer would have to incur that the seller has avoided, such as hiring a CFO, new business development team, or a technology upgrade.

3

Determine the multiple

The market will determine a multiple which, when applied to your adjusted EBITDA, will provide a reasonable target price. However, there are several variables that can impact this figure:

- Well-established project management and business development processes

- Strong relationships with customers

- High profit margins as a percentage of revenue

- Low customer concentration

- Low supplier concentration

- Experienced management team post-transaction

- Strong recurring revenue evidenced in a detailed pipeline

- Outlook on long-term growth of industry

- Comparable multiples paid for other companies in your industry

4

Determine the appropriate multiple for your company

This is an art, not a science! While the M&A advisor will establish a peer group of comparable deals and adjust for intangibles identified in step 3, no two companies or deals are exactly alike. (See the exhibit below for a sample of calculated multiples based on a company’s characteristics.)

5

Calculate your target price

This is the result of the adjusted EBITDA from step 2 multiplied by the appropriate multiple from step 4.

An internal valuation is just a starting point. An M&A advisor will work with you to identify potential buyers, structure the best transaction, and bring the sale through completion. They will conduct a financial analysis of your business, find the appropriate comparable companies, and come to the right valuation of your company. An experienced advisor will make sure you don’t overlook any intangible assets of your company that you may take for granted.

With this knowledge, the M&A advisor will negotiate a good deal on your behalf, i.e., a potentially higher price or better deal terms, and see that you walk away from your company happy.