GovCon

We understand that GovCon M&A is complex. Our mission is to support you, the GovCon owner, so you can lift off to your next goal in life when the time is right.

Working with the federal government requires knowledge of the complex rules and regulations across a set of agencies

Services

Sellside

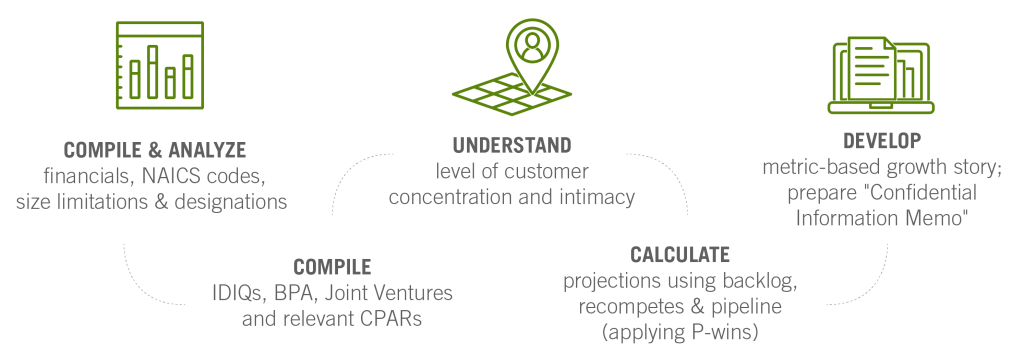

We work with GovCon companies that are 100% Full and Open and those that have set-aside designations. In our view, your company is a portfolio of its contracts. We review a number of critical factors: the actual work being done, the agencies being served, the period of performance on existing contracts, whether contracts are coming up for recompete, the level of customer intimacy, your company’s ability to shape new proposals coming out from the client, CPARs, past performance, funded backlog, pipeline, skill level of employees, clearances and more.

We help you achieve a deeper understanding of how various buyers in the GovCon marketplace, from strategics to private equity, might evaluate your business including the types of questions and financials they may seek along the way. Our team does extensive analysis to better understand how your business stands apart from other GovCon deals. We then develop compelling narratives and effective marketing materials that will attract GovCon buyer interest and expand the prospective buyer pool for you.

GovCon transactions can be structured many different ways, depending on various limitations. It is important to have an M&A adviser who understands GovCon at a deep level and works actively in the space.

Building Your Sales Story

Finding Your Buyers

From LOI to Close

Buyside

We work with GovCon buyers, including private equity funds, seeking to acquire privately held companies serving the federal customer.